When the Right Time to Partner with a Financial Accounting Firms?

Everyone has a dream to start his own business, but sometimes this dream remains incomplete due to obstacles faced by them while starting a business. These include business competition, a lack of funding, not being aware of virtual accounting, poor planning, time constraints, and also being unable to hire the right person to handle accounting and finance processes.

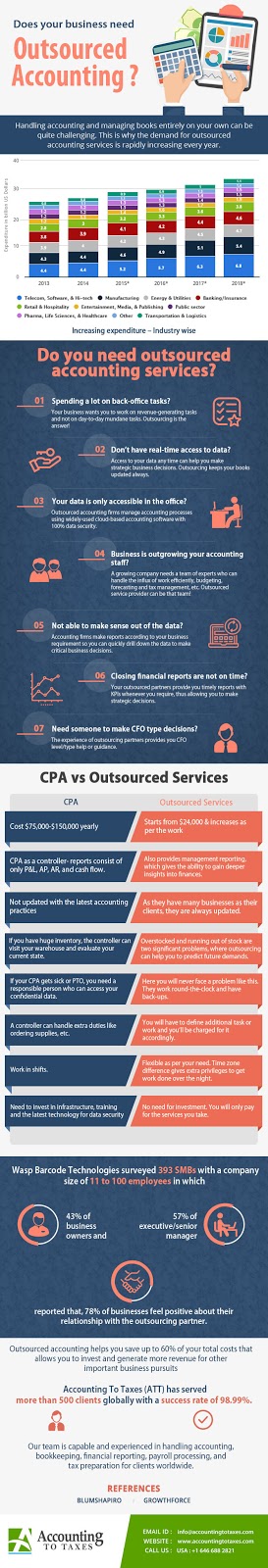

Having the Right Financial Accounting firm helps the business to grow to the fullest and cut out on the cost to achieve the bottom line. Now the question arises when to outsource financial services?

Here are reasons explaining the right time to partner with a financial accounting firm:

1. During the tax season, most business owners struggle with how they can maximize their deductions. An accounting firm supports you to identify potential deductions and help you to make strategic decisions on the year-end deductions.

2. Every business needs to be audited to avoid mistakes like being charitable and applying for excessive write-offs.

3. To focus on running a business, you need to invest in a professional accountant that will assist you in focusing on the core task of your business.

4. If budgeting and cash flow are not steady, they will become a hurdle in real-time. Collaborate with accounting firms to make the right decision based on the latest data.

5. When you have limited access to resources like accounting software, financial accounting firms can help you. Professional accountants have access to the latest accounting software, which they use for your business growth.

Heres , How you can Effectively Manage Financial Accounting and Reporting Services.

Within a business, financial management is a huge responsibility. With a lack of financial system, your business outlook can appear to be slim when looking for business growth. Having an accounting firm by your side will help you in making all the important decisions.

Comments

Post a Comment